Suggested CitationsGuidebook:

Barnett PG, Dally SK, Scott WJ, Gehlert EH. Researcher’s Guide to Estimating VHA Labor Costs. Health Economics Resource Center, VA Palo Alto Health Care System, U.S. Department of Veterans Affairs. January 2021.

Dataset:

Barnett PG, Dally SK, Scott WJ. Researchers' Guide to Estimating VHA Labor Costs: FY2000 to FY2024. Dataset. Health Economics Resource Center, VA Palo Alto Health Care System, U.S. Department of Veterans Affairs. February 2025.

Disclaimers

All tables for this guidebook are saved in an Excel file. Download the tables here.

Many URLs are not live because they are VA intranet-only. Researchers with VA intranet access can access these sites by copying and pasting the URLs into their browser.

For a list of VA acronyms, please visit the VA acronym lookup on the VA intranet at http://vaww.va.gov/Acronyms/fulllist.cfm.

1. Overview

Labor is an important, usually predominant, cost of health care. Estimates of labor cost are needed for economic evaluations, including cost-effectiveness analysis, budget impact analysis, evaluations of efficiency, and in considerations of the relative advantage of making or purchasing a service.

It is especially challenging to estimate the cost of a new health care intervention, as there is no reimbursement rate, relative value weight, or other source that can be used to estimate the resources needed for its production. The analyst must estimate its cost by direct measurement of the labor, supplies, space, and other resources consumed in providing the intervention. This direct measurement method is often referred to as micro-costing. To find the cost of labor, the analyst determines the time spent in delivering the intervention by each type of staff that is involved. For more information on micro-costing staff time, see the HERC guidebook Microcost Methods for Determining VA Healthcare Costs at http://www.herc.research.va.gov/include/page.asp?id=guidebooks#DIRECT. This guidebook describes information on this labor cost. Throughout this report, the term “labor cost” will be used to mean gross cash earnings (salaries) plus the cost of benefits, which average about an additional 30%.

There are three sources of labor costs at the Veterans Health Administration: the Financial Management System (FMS), the Managerial Cost Accounting System (MCA; formerly Decision Support System (DSS)) Account Level Budgeter Cost Center (ALBCC), and the Personnel and Accounting Integrated Data System (PAID). These sources provide information on the salaries and benefits of different types of VA staff. All three sources provide information on the cost of particular types of staff (e.g., physicians, nurse-practitioners, and registered nurses). These job categories are represented by the Budget Object Code (BOC), also called a sub-account.

This guidebook will focus on FMS and MCA ALBCC data. Detailed information on PAID data is available in the “Guidebook for Research Use of PAID Data” (VA intranet-only) available on the HERC intranet site (https://vaww.herc.research.va.gov/files/BOOK_628.pdf).

Data are available for each specific VA medical center. The MCA ALBCC distinguishes labor costs with a specific production unit at a specific medical center. The MCA ALBCC datasets extend back to federal fiscal year (FY) 2000. FMS data precede this.

Both sources provide information on the hours worked and labor costs. MCA ALBCC and FMS give slightly different estimates of labor cost. The difference is largely attributable to the inclusion of contract workers in the MCA ALBCC. The difference is small, and either source will yield similar results. These sources must be used with caution in estimating the labor cost of administrative, temporary, or trainee staff because these job categories are heterogeneous, including a mix of dissimilar employees.

This guidebook proceeds as follows: The next section, Data Sources, describes data from FMS and MCA ALBCC that were used to prepare the labor cost estimates. The Methods section describes the details of our analysis. The Description of File Layout and Variables section describes the HERC-created database of labor cost estimates, including the variables in the dataset. A section on Results discusses differences between the data sources, and identifies some problematic employee types. We conclude with a section of Recommendations regarding use of these data.

1.1. Updates

We have updated Appendix 1 with the most recent steps for accessing the FMS data at VSSC.

2. Data Sources

2.1. Financial Management System (FMS)

The Financial Management System (FMS) is the summary VA general ledger. It provides a detailed breakdown of VA obligations and expenditures by category, location, and fiscal year. FMS data are organized into reports. The FMS 830 Report details the expenditures and workload (staff time) for direct medical care.

Many analysts will find their needs can be met by using preconfigured reports based on FMS data generated by the VHA Support Service Center (VSSC). VHA staff that obtains permission to use VSSC can generate reports using web based tools. For step-by-step instructions of how to create a FMS 830 Report on the VSSC Intranet site see Appendix 1.

Certain analysts may wish to access the complete FMS data. This can be done by converting flat text files (FMS data reports) at the Austin Information Technology Center into a database. Older SAS programs used to read FMS reports no longer work, as the columns of data have shifted in recent years and these shifts are not well documented. The name of the FMS 830 Report at the Austin Information Technology Center is FMSPRD.FMS.FMSTODSS.LINK.monfy, where ‘monfy’ refers to the 3-letter month and 2-number fiscal year (e.g., SEP14 for September of fiscal year 2014). Data summarized at the level of the cost center and budget object code are stored as RMTPRD.MED.SAS.KLFMENU.FMS.monfy. Two other files containing similar information, known as OBLOE and OBOCE, are described in Chapter 3 of the HERC guide “Microcost Methods for Determining VA Healthcare Costs” by Smith et al. (2003). The three sources (OBLOE, OBOCE, and 830 Reports) produce very similar figures for hourly and annual wages for clinical job categories, often falling within 3% of one another. Agreement is lower for administrative positions and miscellaneous benefits categories.

The FMS data characterize costs by cost center, source of funding and budget object code.

2.1.1. Cost Center

The cost center is a four-digit code that corresponds to a VA service, such as ‘Nursing Service’ and ‘Psychiatry Service.’ Cost centers in the range 8201-8286 represent direct medical services. Analysts using FMS data should limit their analysis to this range of cost centers to estimate only the labor cost of medical care staff

2.1.2. Source of funding

FMS tracks costs by appropriation. This is represented by a variable (FUNDNAME) that is typically four to six characters in length, four numbers followed by up to two optional letters. Examples include minor construction (0111), general operating expense (0151A1), medical research (0161A1), and Veterans Canteen Service (4014C). The medical services appropriation (called the ‘medical care appropriation’ prior to FY2004), consists of a half-dozen values, all of which begin with ‘0160’. The vast majority of FMS records (over 98%) for direct medical care cost centers have this source of funding.

2.1.3. Budget object code

The budget object code (BOC), also called a sub-account, identifies the type of expense. There are budget object codes for types of personnel, as well as supplies, contract services, transportation, and capital acquisition. Sub-accounts 1000-1099 are for personal services and benefits. Costs reported in these sub-accounts can be used to calculate average wages. Each value in this range refers to a particular job category, such as ‘Registered Nurses’ or ‘Physicians—Full Time.’ BOCs are defined by the VA Office of Financial Policy. Information on BOCs was previously found in VA Handbook 4671.2. VA Handbook 4671.2 was withdrawn and superseded by Financial Policy Volumes and Chapters (Volume XIII, Cost Accounting) from the VA Office of Financial Policy http://www.va.gov/finance/policy/pubs/.

The costs of a single sub-account may be reported in many cost centers. For example, the sub-account for full-time physicians (1081) will appear under cost centers 8019 (Pathology Service), 8053 (Medical Research Service), and other services. Finding total physician costs requires summing records of all the cost centers that report physician costs. More information on cost centers can be found on the VA Office of Financial Policy website. For more information on MCA/DSS ALB see the HERC guidebook “Researchers Guide to the Account Level Budgeter (ALB): Fiscal Year 2009 Update” at http://www.herc.research.va.gov/include/page.asp?id=guidebooks#STALVL.

2.2. MCA Account Level Budgeter Cost Center (ALBCC) Database

The Account Level Budgeter Cost Center (ALBCC) is a data file from the Managerial Cost Accounting System (MCA, formerly Decision Support System (DSS)), the VA activity based cost allocation system. MCA ALBCC provides information on budgeted and actual expenses and hours of staff time. For more information on MCA/DSS ALB see the HERC guidebook Researchers Guide to the Account Level Budgeter (ALB): Fiscal Year 2009 Update at http://www.herc.research.va.gov/include/page.asp?id=guidebooks#STALVL. Cost data in MCA ALBCC are derived from FMS and from PAID, the VA payroll system. For more information on PAID, the VA payroll system, see the HERC guidebook “Guidebook for Research Use of PAID Data” at http://www.herc.research.va.gov/include/page.asp?id=guidebooks#PROVIDER. MCA ALBCC data characterize costs by production unit (ALB cost center), budget object code, location, and time frame.

MCA ALBCC data are stored at the VA Corporate Data Warehouse (CDW). For more information on how to apply for permission to access the MCA data at CDW, please see the VHA Data Portal at http://vaww.vhadataportal.med.va.gov/. Reports using MCA ALBCC data can be generated by those who have permission to use the MCA reports site: https://mcareports.va.gov/. This site allows tabulation of costs and workload by Budget Object Code, but a wider of possible analyses may be undertaken using the MCA ALBCC SAS databases.

3. Methods

Our objective was to find the hourly labor cost of different types of staff for studies that directly estimate the cost of novel interventions by micro-cost methods. These studies gather information on the number of hours of labor that different types of staff spend in providing the intervention. The analyst needs an hourly labor cost to determine the cost of this work. HERC provides economic researchers with the hourly cost of each type of VA labor (see Chapter 4). These data include wages and direct costs such as benefits and the employer contributions to payroll taxes. Types of staff were distinguished by the budget object code (BOC).

3.1. Financial Management System (FMS)

We tabulated data in the VA Financial Management System (FMS) using the reports generator at the VHA Support Services Center (VSSC) website. The procedure we used is described in Appendix 1 of this guidebook. The report provided the total cost and full time equivalent employees (FTEE) for direct medical expenditures cost centers for each BOC.

To find the hourly cost, we first calculated total hours of workload by multiplying the FTEE by the number of weekdays (Monday-Friday) in the fiscal year times 8 hours per day. (See Table 1 for the total number of weekdays in each fiscal year.). We then divided the total fiscal year expenditures for each BOC by the total hours of workload to find the average hourly cost of labor.

FMS reports are prepared monthly and give the expenditure and workload for the fiscal year-to-date. Since the Federal Fiscal Year ends on September 30, September data include the expenditures and workload for the entire fiscal year. We used FMS data on direct medical care at VHA facilities. This care is reported in FMS cost centers in the range 8201-8286. We extracted all records for sub-accounts (BOCs) 1000-1099 and restricted the analysis to cost centers 8201 to 8286.

3.2. MCA Account Level Budgeter Cost Center (ALBCC) Data

We used the end of year MCA ALBCC file. We restricted our analysis to include only cost centers (CC) 201-286. (Cost center values in the MCA ALBCC file drop the leading “8” from the cost center codes used in FMS.) We tallied year-to-date expenditures (ACT_DLLR) and year-to-date hours (ACT_HOUR) across all records within each Budget Object Code (BOC). We found the hourly labor of cost each BOC by dividing total cost by hours of labor.

4. Description of File Layout and Variables

HERC created a data set with the total labor costs, workload (hours), and hourly labor costs for each data source, by Budget Object Code and fiscal year. All cost values are in nominal dollars, meaning that they have not been adjusted for inflation.

4.1. File Layout

The Labor Cost dataset is formatted as a Microsoft Excel workbook. The first worksheet is named Introduction and contains a list of all tables in the workbook. Table 1 lists the number of weekdays and work hours per fiscal year. Table 2 lists the variables by column as they appear in the labor costs dataset. Table 3 contains the actual labor cost data, with one row for each fiscal year and budget object code (BOC). There are 13 variables in the VHA Labor Cost estimate tables.

4.2. Description of Variables

A brief description of all variables in the HERC labor cost dataset is included below for quick reference.

FY: Federal fiscal year, represented as a four-digit number. The federal fiscal year runs from October 1 through September 30.

BOC: Budget Object Code. This is a four-digit number between 1000 and 1099, corresponding to a specific sub-account or job category. For more information on BOC see the Financial Policy Volumes and Chapters (Volume 13) from the VA Office of Financial Policy at http://www.va.gov/finance/policy/index.asp.

BOC NAME: The name associated with the Budget Object Code, as it appears in the FMS data produced by the VSSC FMS 830 Report. Names from FY2008 forward were checked against Financial Policy Volumes and Chapters (Volume XIII, Cost Accounting) from the VA Office of Financial Policy, found at http://www.va.gov/finance/policy/pubs/. Names were edited as necessary to match this document. (Many of the names in the FMS data from VSSC appeared to be truncated or abbreviated.)

There are two notable changes in BOC name over time. Effective April 2006, BOC 1049 changed from ‘Clinical Pharmacology Fellows’ to ‘Neuroscience and Traumatic Brain Injuries.’ Also effective April 2006, BOC 1062 changed from ‘Chief Nurse Trainees’ to ‘Administrative Nurse Trainees.’ In addition, the definition of BOC 1076 may have changed from ‘Dentist-Residents, Career’ to ‘Chiropractors,’ but this discontinuity does not exist in the current versions of FMS data at the VSSC site.

FMS Total Expenditures: Total annual expenditures based on FMS data from the VSSC report.

FMS FTE: Total annual full-time employees (FTE) based on FMS data from the VSSC report.

FMS Total Hours: Total annual hours based on FMS data, calculated by multiplying FMS FTE by the estimated number of working hours in a year. Although 2,000 working hours per year is the common rule of thumb, a more accurate estimate of working hours is based on the actual number of weekdays (Monday-Friday) in each fiscal year. The number of weekdays is then multiplied by 8 hours per day. Refer to Table 1 for the number of weekdays in each fiscal year.

FMS Hourly Rate: Average hourly labor cost based on FMS data, calculated by dividing FMS Total Expenditures by FMS Total Hours. If this division results in a negative value, a value greater than $1000, or is undefined (i.e., division by zero) the worksheet cell was left blank.

FMS Notes: Indicator to flag and define problematic FMS data. This cell contains a “1” if the FMS hourly rate is calculated to be negative, greater than $1000, or is undefined. The cell contains a “2” if no records were found in the FMS data for the specified fiscal year and BOC. In both of these cases, the FMS Hourly Rate cell was left blank. For records marked with a “2” the FMS Total Expenditures, FTE, and Total Hours cells were also left blank.

MCA Total Expenditures: Total annual expenditures based on MCA ALBCC data. This was calculated by summing the variable ACT_DLLR across all records for a given fiscal year and BOC.

MCA Total Hours: Total annual hours based on MCA ALBCC data. This was calculated by summing the variable ACT_HOUR across all records for a given fiscal year and BOC.

MCA Hourly Rate: Average hourly labor cost based on MCA ALBCC data. This was calculated by dividing MCA Total Expenditures by MCA Total Hours. If this division results in a negative value, a value greater than $1000, or is undefined (i.e., division by zero) the worksheet cell was left blank.

MCA Notes: Indicator to flag and describe problematic MCA ALBCC data. This cell contains a “1” if the MCA hourly rate is calculated to be negative, greater than $1000, or is undefined. The cell contains a “2” if no records were found in the MCA ALBCC data for the specified fiscal year and BOC. In both of these cases, the MCA Hourly Rate cell is blank. For records marked with a “2” the MCA Total Expenditures and Total Hours cells are also blank.

Percent Difference: Difference between MCA and FMS hourly rates. This was calculated as a percentage of the MCA hourly rate:

Percent Difference = (FMS Hourly Rate – MCA Hourly Rate) / MCA Hourly Rate

A negative value indicates that the FMS hourly rate was less than the MCA hourly rate, while a positive value indicates the MCA hourly rate was less than the FMS hourly rate. The percent difference is shown as zero if either one of the hourly rates was blank. Percent differences greater than 3% (either positive or negative) are highlighted in pink.

5. Results

We calculated the hourly labor cost of different types of VA employees, identified by Budget Object Code, using two different sources of financial data: FMS and MCA ALBCC

For most important types of labor, these sources provided nearly identical average hourly cost. We calculated the percentage difference in the hourly cost reported by these sources, identifying the percentage difference between FMS using MCA ALBCC as the reference comparison. For most BOCs in most years, the difference was less than one percent. Nearly all sub-accounts differed by less than five percent.

Total labor costs and total labor expenditures were also quite similar for common job categories, such as registered nurses and full time physicians. However, there was considerable difference between the data sources in certain job categories.

5.1. Differences in Data Sources Regarding Contract Labor Costs

Contractors are used to fill a variety of clinical roles, including nursing, surgery, and in providing specialized services, such as renal dialysis and cardiac catheterization. FMS and MCA ALBCC account for the costs of contract labor differently.

FMS includes contract labor costs, but assigns them to BOC codes in the 2000-2999 range. FMS labor costs in BOCs in the 1000-1099 range exclude contract labor.

MCA site teams obtain detailed information on contracts in order to assign these costs to BOC in the range 1000-1099. Costs reported by MCA ALBCC in BOCs in the 1000-1099 range thus include the costs of contract labor. Since some contracts specify payment by the service, regardless of the time required to provide it, MCA staff may need to estimate the number of hours worked. As a result, some MCA data on the hours worked by contract labor may lack precision.

5.2. Differences in Data Sources with Respect to Common Job Categories

Most researchers need the labor cost of common clinical jobs such as full-time physician, registered nurse, or social worker. Hourly labor costs for these BOCs were similar in the two data sources; however, MCA ALBCC has a marginally higher per hour cost. The higher costs found in MCA ALBCC are attributable to the inclusion of contract care.

For example, full-time physicians have a consistently higher per hour labor cost in MCA than in FMS, by approximately $5 per hour. Registered nurses are also consistently more costly in MCA ALBCC than in FMS but the per-hour cost difference is smaller than in full-time physicians. Social worker labor costs are very similar in MCA ALBCC and FMS. For more information, please refer to HERC Technical Report 25: A Guide to Estimating Wages of VHA Employees—FY2008 Update at http://www.herc.research.va.gov/include/page.asp?id=technical-reports.

5.3. Differences in Data Sources with Respect to Less Common Labor Categories

There are more substantial differences between FMS and MCA ALBCC data for Budget Object Codes for administrative, temporary, and trainee accounts.

Trainees (BOC 1051, 1052, 1053, 1054, and 1056) and clinical residents (1073, 1077, 1083, and 1088) have very similar total spending in the two data sources but much greater workload (hours) in MCA ALBCC. As a result, the hourly rate based on MCA ALBCC is lower.

FMS reports the cost of benefits for BOC 1011, 1012, and 1013, with no information on wages or FTE. These BOC contain only the employer contribution to FICA (Social Security) taxes for physicians, dentists, and consultants.

Sub-account 1078 reflects the cost of certain benefits afforded to employees who are otherwise unpaid, or “without compensation” (WOC). This is reported in both data sources as an expenditure without any associated workload.

Some BOC in which there are discrepancies between the data sources in earlier years’ data (including BOC 1060, 1070, 1090, and 1098) are no longer being used.

6. Recommendations

We make the following recommendations to researchers who need an estimate of the hourly cost of VHA labor:

Both FMS and MCA ALBCC datasets are acceptable for estimating labor costs for common clinical job categories and will report very similar figures. MCA ALBCC data will produce costs that are slightly higher than those reported in FMS, due to the inclusion of contract care costs.

The hourly cost of some labor categories are based on a small number of observations, or on data in which labor costs are not matched to hours of work. These observations have been flagged in the HERC dataset of hourly labor costs. The analyst should be careful not to rely on hourly cost estimates that are improbable. If the BOC is for a type of labor that is important to the analyst, one approach would be to analyze the underlying data (FMS or MCA ALBCC) and exclude records with mismatched cost and workload.

There is no clear basis for preferring FMS or MCA ALBCC for estimating labor costs of administrative staff. In the context of a prospective study, we instead recommend surveying employees or managers. If one of the two sources is chosen for a retrospective study, a sensitivity analysis should be performed using figures from the other source.

We do not recommend using either of these data sources for the labor cost of trainees. The trainee categories include people at many different salaries and levels of experience, rendering an average salary useless. A more accurate method would be to survey managers of trainees at a small but representative set of VA medical centers.

We recommend using a single source for estimating labor costs. Combining FMS data for certain years with MCA ALBCC data from other years could produce discontinuous jumps or falls in estimated labor costs.

There are considerable regional differences in VA labor costs. If it is important to know the hourly labor cost in a specific locality, the analyst should not use the national cost estimates described in this report, but extract the actual VA cost for the region in question. Regional differences in VA cost are especially pronounced for nurses. Nursing wages are set by a process that is influenced by the pay rates for non-VA nurses in the same locality.

Alternate sources of information of the wages and labor cost of health care workers may not be comparable to these VA data. These sources include Medicare wage surveys, the American Medical Association annual survey of physicians, the Bureau of Labor Standards labor cost data (published in the annual Federal Register), and data collected annually by the California Office of Statewide Health Planning and Development (OSHPD). Most of these sources report wages exclusive of benefits, whereas the VA data described in this report include the cost of benefits.

References

Chow A, Roumiantseva D, Barnett PG, Wagner TH, Yang J, Harden CM. Researchers’ Guide to the Account Level Budget (ALB): Fiscal Year 2009 Update. Menlo Park, CA: Health Economics Resource Center, 2010.

Murphy PA, Cowper DC, Frisbee KL. Researchers’ introduction to KLFMenu Pre-Defined Reports and Dataset Contents. VIReC Insights 2002; 3(2):1-5.

Smith MW, Barnett PG, Phibbs CS, Wagner TH, Yu W. Microcost Methods for Determining VA Healthcare Costs. Menlo Park, CA: VA Palo Alto, Health Economics Resource Center, 2003.

Smith MW, Velez JP. A Guide to Estimating Wages of VHA Employees. Technical Report 12. Menlo Park, CA: VA Palo Alto, Health Economics Resource Center, 2004.

Smith MW, Barnett PG. Research Guide to the VA Financial Management System (FMS). Menlo Park, CA: Health Economics Resource Center, 2010.

Smith MW, Cheng A. A Guide to Estimating Wages of VHA Employees – FY2008 Update. Technical Report #25. Menlo Park, CA. VA Palo Alto, Health Economics Resource Center; 2010.

Appendix 1. Using VSSC to Access FMS Data

The following steps were used in creating the FMS 830 Report from the VHA Support Services Center (VSSC) website; this is the FMS source that HERC used in creating the VHA Labor Cost dataset.

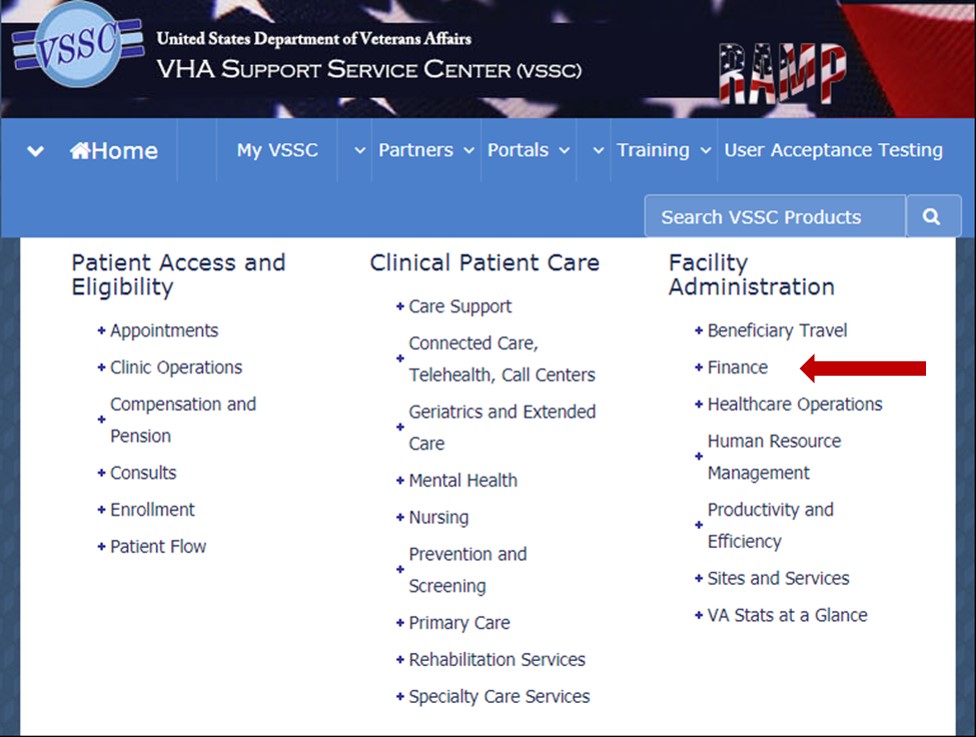

Access the VSSC website at https://vssc.med.va.gov/. Note: This link directs you to an internal VA website that is not available to the public.

Under the heading ‘Facility Administration’ click on Finance. This should open the VSSC ‘Finance’ page.

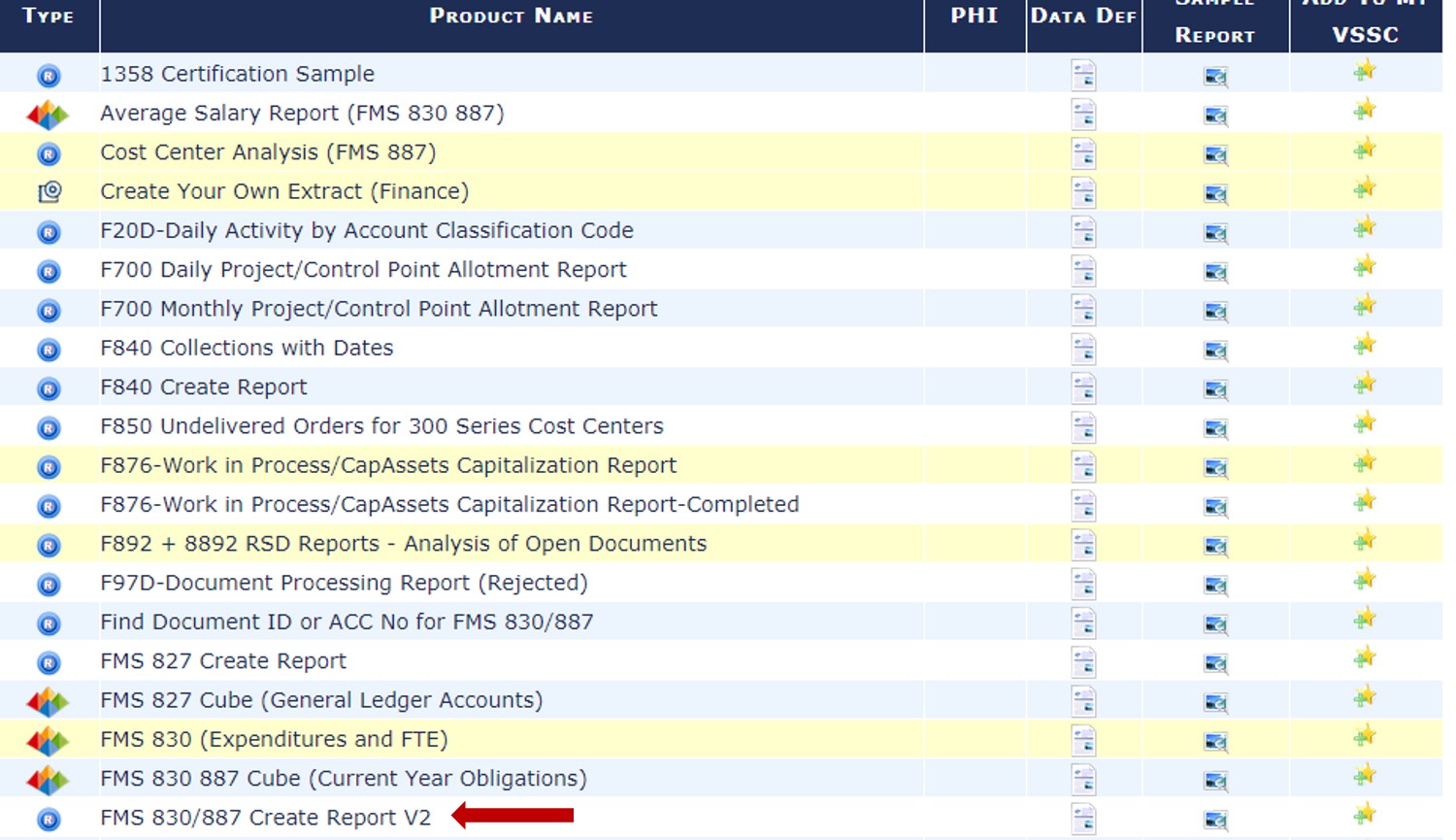

On the ‘Finance’ page, under ‘Click on a radio button to filter by subject area’, select FMS Expenditures, Obligations, FTEE, MCCF. The FMS Product List should open below.

On the FMS Product List, click FMS 830/887 Create Report V2.

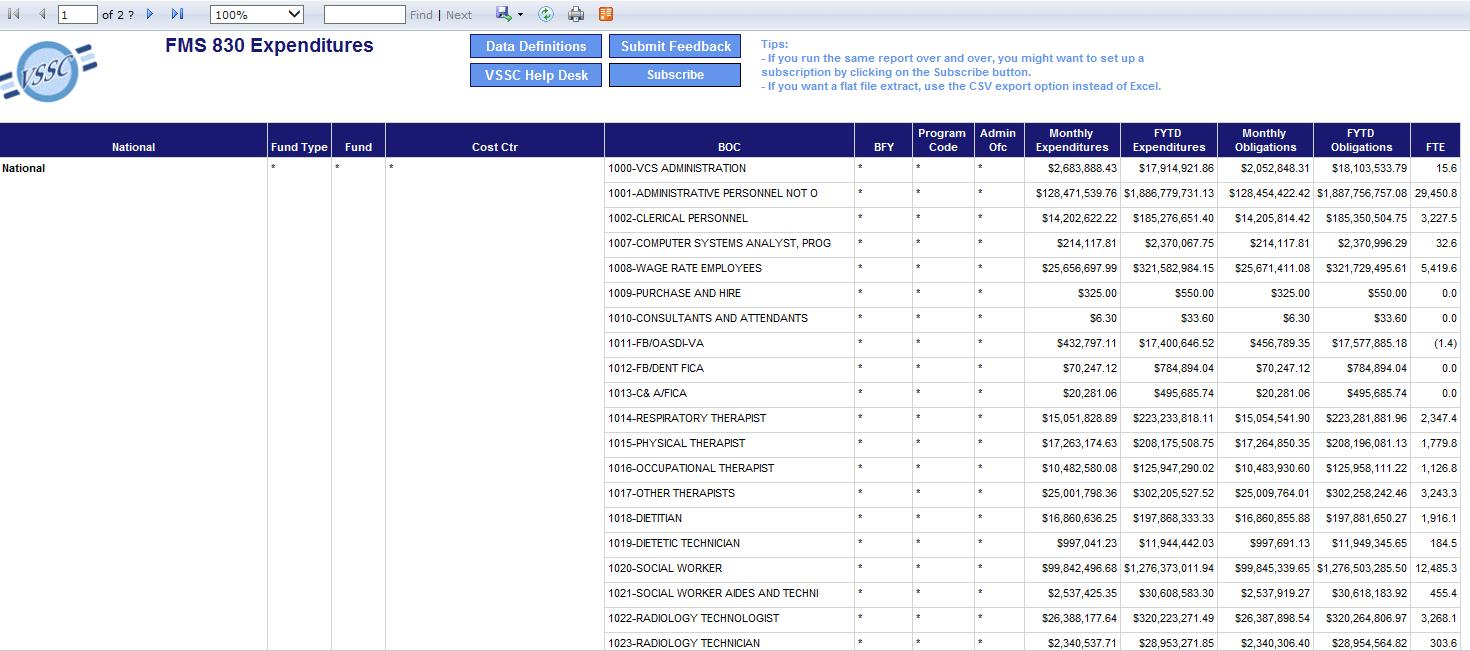

This will open a new window with fields to complete in order to create the FMS 830 Report. The directions below will produce the same FMS 830 Report used in creating this dataset. Once you have made selections for each available field, click 'View Report' on the far right.

Select FY: Select the fiscal year you’re interested in

Select month: We selected September, as the Fiscal Year-to-Date Expenditures will show the entire fiscal year

Select Summary Level: National (Note: The Summary Level could be adjusted to a more local level if relevant to a specific project.)

Select Station/VISN/Natl: National

Finest Breakout Level: National

Select Fund Summary Level: Select All

Select Fund:

Select CC Summary Level: (8200) Direct Medical Care-VA Facil

Select Cost Center: Range 8201-8286

Select BOC Level: (1000-1099) Personnel Services

Select BOC: Range 1000-1099

Select BFY: The same fiscal year as #1

Select Program Code: Select All

Select Admin Office: Select All

Break out separately by: BOC

Select Report Type: FMS 830 Expenditures

The FMS 830 report will open below.

AcknowledgementsWe would like to thank Mark Smith, Samuel King, and Alexander Cheng for their previous work on documenting and estimating wages of VHA employees (see Technical Report #25 and dataset at http://www.herc.research.va.gov/include/page.asp?id=technical-reports).

Last Updated: March 15, 2022